Guidance from a Broken Arrow Real Estate and Estate Planning Attorney Real estate investors often…

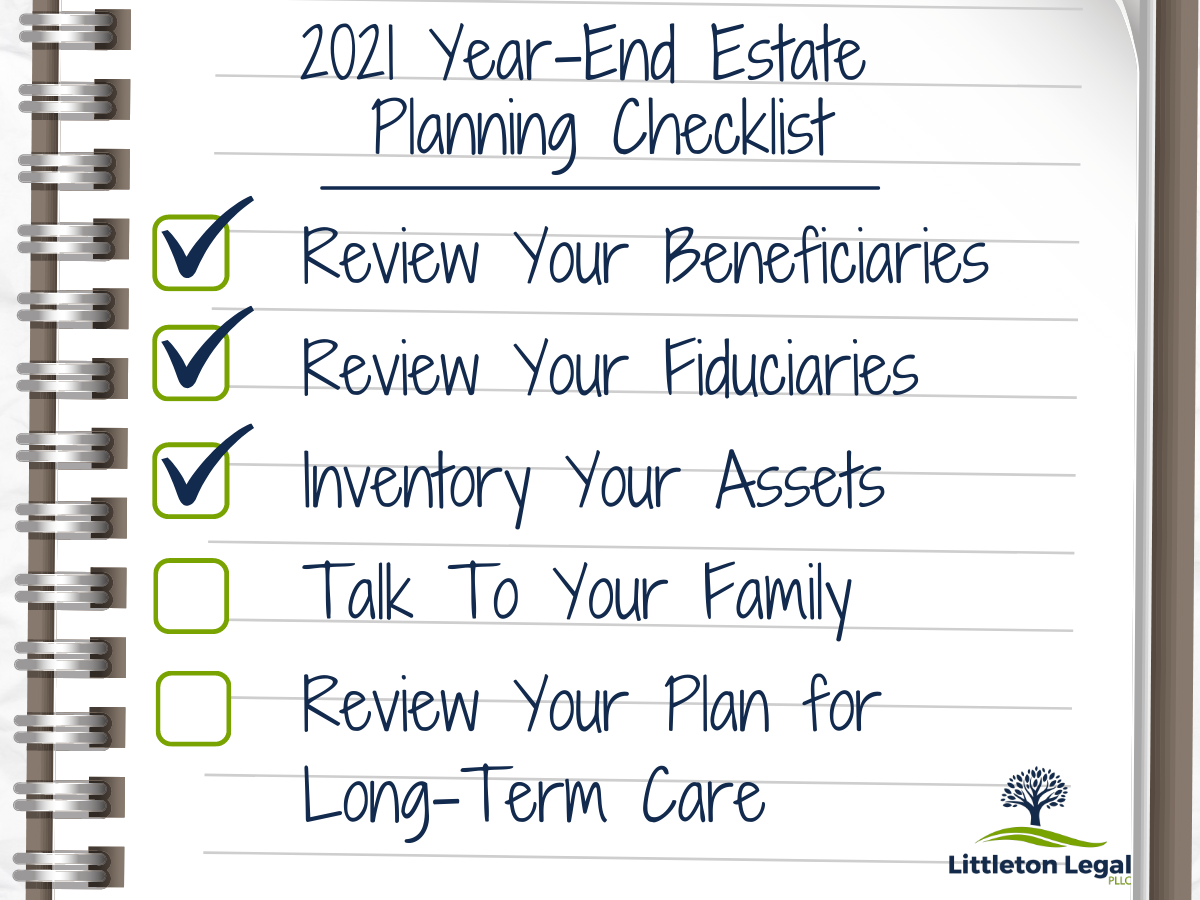

Year-End Estate Planning Checklist

As you start preparing your year-end and holiday season to-do checklist, do not forget to add making sure that your own personal affairs are in order. Here are eight things to add to your checklist as you review your estate plan:

Table of Contents

- 1. Financial Gifts

- 2. Review Your Beneficiaries

- 3. Review Your Fiduciaries

- 4. Inventory Your Assets

- 5. Document Your Competency

- 6. Review Your Plan for Long-Term Care

- 7. Talk to Your Family

- 8. Final Note: Don’t Delay Your Estate Plan

1. Financial Gifts

Have you made a substantial financial gift to a loved one this year? Make sure you are meeting your gift goals by the end of December, especially if you make gifts as part of your estate or tax planning strategy. Remember that any gift more than $15,000 to an individual must be reported by the gift giver on a gift tax return. However, gift taxes are only due if you have already used your lifetime exemption.

2. Review Your Beneficiaries

Your beneficiaries are the people you have said will receive your assets after you die. As time passes, people’s needs, wishes, and goals change. Consider whether your currently named beneficiaries still align with your intent. You will want to review not only the current beneficiaries identified in your will or trust, but also any transfer-on-death beneficiaries of retirement accounts, bank accounts, and investment accounts.

3. Review Your Fiduciaries

Is the person whom you nominated to make health care and/or financial decisions for you upon your incapacity still the best person for the job? Is the person you chose as your executor or trustee still willing and able to administer your estate upon your death? If the answer to either of these questions is no, then update your estate plan to identify the decision-makers you would like to act on your behalf instead.

4. Inventory Your Assets

Have you purchased a new home, sold a business, or been left an inheritance? You don’t want new assets to be subject to probate or other unintended costs, and you don’t want to cause a problem for your beneficiaries by leaving valuables out of your will or trust. If you have a high-net-worth, you should speak to your estate planning attorney and tax advisor about potential changes to the law that, if passed, could significantly impact your estate plan strategies.

5. Document Your Competency

If you are concerned that your estate plan could be challenged by scorned heirs arguing that your mental incapacity or ill health should void your plan, ask your estate planning attorney to help you show you were competent. Options having a signed doctor’s statement of competency, having a trained professional complete a competency assessment, and having the witnesses of your estate plan sign that you were “of sound mind and memory” when you signed your documents.

6. Review Your Plan for Long-Term Care

Do you know how you will pay for long-term care if you should need it in the future? Options include paying out-of-pocket as you need care, purchasing long-term care insurance, proactive asset protection planning, and crisis planning to expedite Medicaid qualification should you need to be in a nursing home before you plan. The best choice for you depends on your assets, your health, your family circumstances, and your risk tolerance.

7. Talk to Your Family

Family conflict is the biggest threat to estate planning. Schedule a time to sit down with your spouse, adult children, parents, and other key family members to review your estate plan. If you are concerned about privacy, you can share general information instead of specifics.

8. Final Note: Don’t Delay Your Estate Plan

The checklist tips above address things to do to review your existing plan. However, if you still have not yet completed at least a basic estate plan, then commit to yourself that you will start the process before the year ends so that you ring in 2022 with peace of mind.

Call Littleton Legal today at (918) 608-1836 to schedule your complimentary consultation